Routes Europe 2024 Top Stories

Featured Aerospace News

Featured Defense & Space News

Featured Air Transport News

Featured MRO News

Featured Business Aviation News

Aviation Week Intelligence Network (AWIN)

Access authoritative market insights and locate new business with access to company, program, fleet and contact databases - only available with AWIN.

Podcasts

Apr 19, 2024

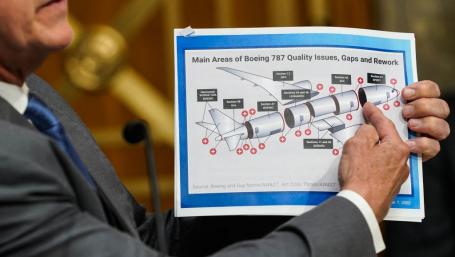

A Boeing engineer has come forward to challenge claims made by the OEM on the long-term safety of the 787, sparking a new round of scrutiny for the beleaguered manufacturer. Aviation Week editors break it all down.

Apr 18, 2024

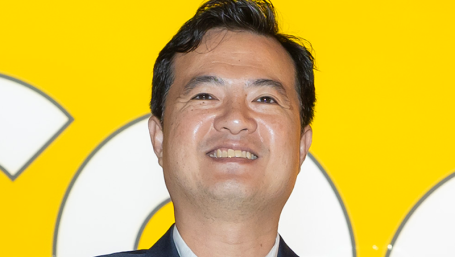

CEO Leslie Thng explains how Scoot has become one of the world’s most successful budget airlines and why it is introducing the Embraer E190-E2 to its fleet.

Apr 12, 2024

Listen in to the first-ever MRO Podcast to be recorded live in front of an audience as Aviation Week's team share their takeaways from MRO Americas 2024 in Chicago.

Apr 11, 2024

Listen in as Aviation Week Network editors discuss the changing fortunes of airlines as passengers focus on premium services and brand.

Apr 11, 2024

Aviation Week's Mike Lavitt and Molly McMillin discuss news from this year's Sun 'n Fun event.

Aviation Week Knowledge Center

Access our growing collection of digital resources from thought leaders around the industry.

Webinars

Recent unprecedented gains in used aircraft valuations since 2021 have been the most recent new normal but fresh business aviation developments have…

Hear directly from our analysts as they discuss the trends from Q1 and what to look out for the rest of 2024. Each quarter, our team will host a live…

Hear directly from our analysts and editors as they detail the trends from Q1 and what to look out for the rest of 2024. In this new format, you also…

Apr 03, 2024

New rockets, lunar landings, military space initiatives, accelerating M&A and more commercial satellites streaming into low-earth orbit. 2024 is shaping up to be the most dynamic year the space industry has seen in a long time.

Amidst a heated election year, the Defense Department’s $850 billion request for fiscal 2025 plays it safe, with few headlining-grabbing policy or…

Discover our Portfolio

Delivering award-winning journalism, deep data and analytics, world-class events, and content-driven marketing services, our core principle is helping our customers succeed by enabling them to Know, Predict and Connect.